Bhushan Steel Plant is the global leader in steel and value-added products. The company has collaborated with JFE Steel of Japan to leverage state-of-the-art technologies to meet quality standards and offer high-value steel products.

Currently, the products designed by the company are widely used across various industrial sectors such as infrastructure, construction, electrical appliances, automobiles, etc. The BPSL has successfully commissioned more than 3.5 million TPA Greenfield Steel and Power Plant in Orissa.

Besides that, the BPSL has an end-to-end portfolio that enables them to offer a broad spectrum of products with utmost customer satisfaction. The new advancements and collaboration make it the most successful Alloy Steel Long Product business. Let’s take a deeper insight and learn about the company in detail.

Contents

Bhushan Steel History

Bhushan Power & Steel was established in 1970, and in 1999 the company was incorporated and recorded with the registrar of companies in Delhi. In 1973, this power and steel company established its first flair in Chandigarh to manufacture wire rods and Tor steel. At present, BPSL has seven manufacturing plants in India. Sanjay Singal endorsed the company.

In September 2019, BSPL was obtained by the JSW Steels (The global steel manufacturing leaders) with an offer of INR 17,700 crores which the NCLT further approved. Furthermore, in October 2019, the Enforcement Directorate also attached assets of BSPL worth Rs 4,025 crores regarding the enduring probes.

This is the only Indian company with a strong presence worldwide, including in Europe and the USA. It has been ranked amongst the 15 biggest global steel producers by the World Steel Dynamics since 2008. The company has covered 14 locations in India and worldwide to show its technological empowerment.

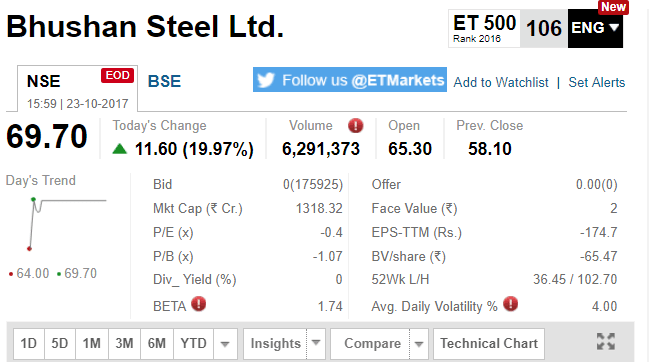

Bhushan Steel Highest share price and lowest prices are as follows:

- Highest Share Price- 109.70- May 2021

- Lowest Share Price-15.70 – March 2020

- Average difference-94.60

- Average Share Price- 39.68

- Charge%- 100.35

Bhushan Steel Career

Bhushan Steel Career offers the most rewarding, challenging, and inspirational career opportunities for deserving candidates. The recruitment is generally done through a direct sourcing model. So, if you are passionate about having a successful career and have any of these skills, you’re welcome to apply.

- Computer Engineers

- Product Engineers and Computer Data Entry Operators

- Industrial Engineers

- And many more.

Visit the website and search for better job options for more job opportunities.

Bhushan Steel Top Competitors

These are some of the competitors of Bhushan Steel.

- Hindalco

- Jindal Steel

- Hindalco

- Tata Steel BSL

- Shyam Metalics

- Godawari Power

- Jindal Stainless

- Jindal

- KIOCL

- APL Apollo

- SAIL

- NMDC

Why & How Tata Group Acquired Bhushan Steels

Tata Steel Ltd. Group acquired the BPSL under the bankruptcy and insolvency code (IBC) in the financial year 2018. The company, after its acquisition, merged the name and is now called Tata Bhushan Steel Ltd. In 2019, after the acquisition, more funds were raised to Rs 37,073,69 crores by convertible debts and other forms of debts.

TSL has created a special strategy and purpose vehicle for the acquisition process. The process was incorporated in 2018; BSL acquired the SPV of the Tata Steel Limited, set up to ease down the acquisition process of the Bhushan Steels under the process of corporate insolvency resolution IBC in 2016.

On 22 March 2018, TSL successfully declared the resolution application successful by the CoC (Committee of Creditors) of Bhushan Steel. The whole scrounge was raised by the Bhushan Steel Limited that would be backed by LoC (Letter of Credit) from the Tata Steel limited.

Finally, the acquisition can be funded by around Rs 18,000 crores of the TSL’s capital, including internal generation. Rs 16.500 crores of the debts are strained on 100% owned subsidiary Bamnipal Steel which also holds equity in Bhushan Steel.

Conclusion

Since the day of establishment and bankruptcy, including acquisition by the Tata Steel Limited, Bhushan Power and Steel Ltd has come a long way. Moreover, with the collaboration of JSW steel, the global steel leader, the company successfully shows its remarkable presence worldwide.

With more than 14 Indian and international locations, the company stands on the strong point as a global steel manufacturer and leverages high-tech technologies to design products.

Hi, This is Ayush Badhoni a passionate blogger from India, loves in researching and writing on various topics like home appliances, gadgets, beauty e.t.c I love to review products and give the best to my readers.